Learn

Alternative Assets

Alternative assets are investment options outside of traditional stocks, bonds and cash. They cover a wide range of investments with unique characteristics. Some of the more common types include:

Commodities

Collectibles

Real Estate

Infrastructure

Private Equity

Structured Products

Hedge Funds

Private Debt

Crypto

Traditional Assets

Liquid

1

2

Numerous and passive owners

3

Open to public and institutions

4

Highly regulated

5

Extremely correlated to market

6

Low minimum investment

7

Low transaction costs

8

Extensive historical data

VS

1

Largely illiquid

2

Owners actively growing value

3

4

Less regulated

5

Low correlation to public markets

6

Higher minimum Investment

7

Higher transaction costs

8

Limited historical data

Alternative Assets

Accredited investors & institutions

The Difference

Alternative investments are one of the most dynamic asset classes, offering the ability to secure superior returns and portfolio diversification. Key differences between traditional and alternative investments include:

With emerging investment structures and new technologies, such as blockchain and NFTs, alternative assets are becoming increasingly accessible to smaller investors.

Potential barriers in relation to liquidity, minimum investment amounts and transaction costs are being overcome. In particular, this has positively affected the market for collectibles.

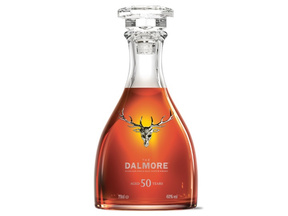

Collectibles - Returns

Argyle Pink Diamonds

Artprice 100

Rare Whisky Apex 1000

K500 (Classic Cars)

Liv-ex 1000 (Wine)

S&P 500

Collectibles have become a popular investment option thanks to their unique appeal and potential for significant returns. The collectibles market size was estimated at US$458 billion in 2022 and is projected to cross US$1 trillion by 2033, growing at a CAGR of 6.2% (Source: Market Decipher).

Over the past two decades, many collectibles have achieved better returns than traditional investments. To enable investors to monitor trends, the performance of many collectibles categories are now captured via specific indices, such as outlined below.

CAGR:

Argyle Pink Diamonds

9.24%

Fine Artwork

8.89%

Artprice 100

Rare Whisky

15.62%

RW Apex 1000

Classic Cars

7.06%

K500

Fine Wine

8.49%

Liv-ex 1000

S&P 500

4.54%

Dividends Excluded

Asset Guides

Rare Whisky

Coloured Diamonds

Watches

Download Guide

Download Guide

Download Guide

Currency

Gemstones

Handbags

Download Guide

Download Guide

Download Guide

Movies & Music

Download Guide

Spirits

Fossils

Download Guide

Download Guide

Fine Artwork

Download Guide

Vehicles

Download Guide

Rare Books

Download Guide

Wine

Download Guide

Artifacts

Download Guide

Sports Memorabilia

Download Guide

Fracture

@ All Rights Reserved

FAQs

Get to know us

Our Team

Careers

Blog

Lets work together

Partnerships

Tokenise assets

Success stories

Need help

Contact us

Help Centre